DISCRETIONARY PORTFOLIO MANAGEMENT WITH A DIFFERENCE

All Traditional investment Opportunities are made available through Croft Financial Grouop.

Your expectations are simple...

Protect and preserve my capital, help meet my objectives for growth and income, and demonstrate value for the fees I’m paying.

What makes us different?

We work hard for you, Our methodology combines a low-cost, tax-efficient approach with ongoing active management for all account sizes. We specialize in the utilization of sophisticated option strategies most managers can’t or won’t use. Portfolio management helps us mitigate your risk and maximize your returns in uncertain markets.

Option Strategies

Most money managers follow a traditional approach to investing but these are not traditional times. You need a portfolio management firm that uses all of the tools available to help meet your objectives. R.N.Croft Financial Group has been using equity and ETF option strategies for over 25 years.

What does this mean for you?

In good markets, you benefit from equity growth, dividends and consistent cash flow from our option strategies. In challenging times, we offset market volatility and mitigate risk through market appropriate holdings and increased cash flow from the option strategies we apply.

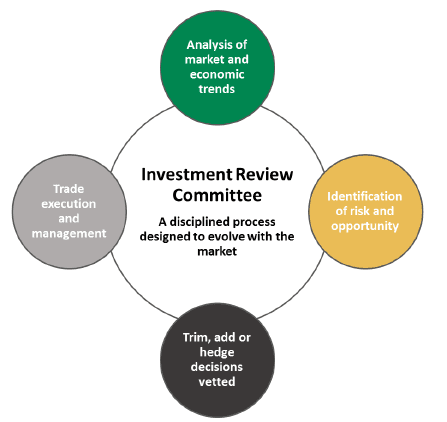

Multiple perspectives and a team approach ensure that management decisions are vetted through an active and consistent process with the objective of seeing and exceeding the expected returns of a traditional portfolio.

Investment philosophy

We manage risk first and enhance return second, which helps you remain comfortable during challenging markets and makes it easier to stick to your goals.

We react quickly

to changing market conditions and seize opportunities when and as presented using strategies most managers don't have the expertise or experience to use.

We are disciplined

and our investment process is designed to evolve with the market. Our Investment Review Committee meets several times per week and takes multiple perspectives into consideration. This team approach ensures management decisions are well thought out and vetted through an ongoing, consistent process.

You need a portfolio management team that uses all of the tools

available to help meet your objectives.

Account Types

- Canadian & U.S. margin and cash accounts

- Individual and Spousal RRSP

- RRIF, LIF and LIRA

- RESP and RDSP

- TFSA

- Corporate

- Individual Pension Plans

Independant Accounts

Your assets reside at National Bank, home of over 500,000 Canadian investors. Your accounts are insured under the Canadian Investor Protection Fund and you have online access to review your portfolio and account statements any time. There are no custody fees for registered accounts, and no transaction costs.

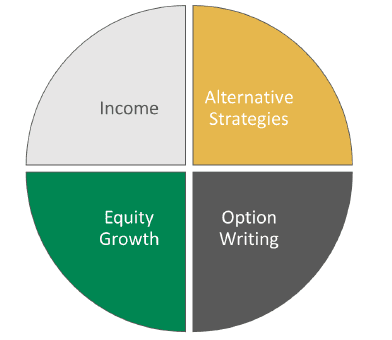

Investment mandates may include 4 share classes at the managers’ discretion

Our mission is to deliver discretionary portfolio management expertise with outstanding service. We do this for both individuals and institutional investors. Our strategy is to balance performance with your preferred level of risk tolerance.

R.N. Croft Financial Group Serves you

by seeking to achieve industry leading performance through a disciplined investment methodology, uniqute strategies, tax efficient porfolios with low fees, transparency and enhanced communication.

With representation across Canada, our goal is to build lasting relationships that endure through challenging times and keep you focused on your longer term objectives.

Company Snapshot

- Investment Counsellors and Portfolio Managers

- Option market specialists

- Held to a fiduciary standard of care

- 25 years in business

- Over $400 million under management

- Over 1200 Families across Canada

- 4 actively managed share classes

- Custom solutions for high net worth clients

- Accounts held at National Bank & insured by CIPF

Held to a fiduciary standard

We are held to the highest standard in the industry. We have a fiduciary duty to act with care, honesty and good faith, always in the best interest of our clients. Investment decisions must be independent and free of bias. This results in a higher level of trust.

We have spent considerable time working with industry regulators to ensure that our conduct and practises meet and exceed the industry standard.

For an overview of our investment methodology, fees and performance, speak to Tim today.

We work with multiple Portfolio Managers at RN Croft Financial Group, and they are an integral part of helping my clients build a flexible and sustainable portfolio.

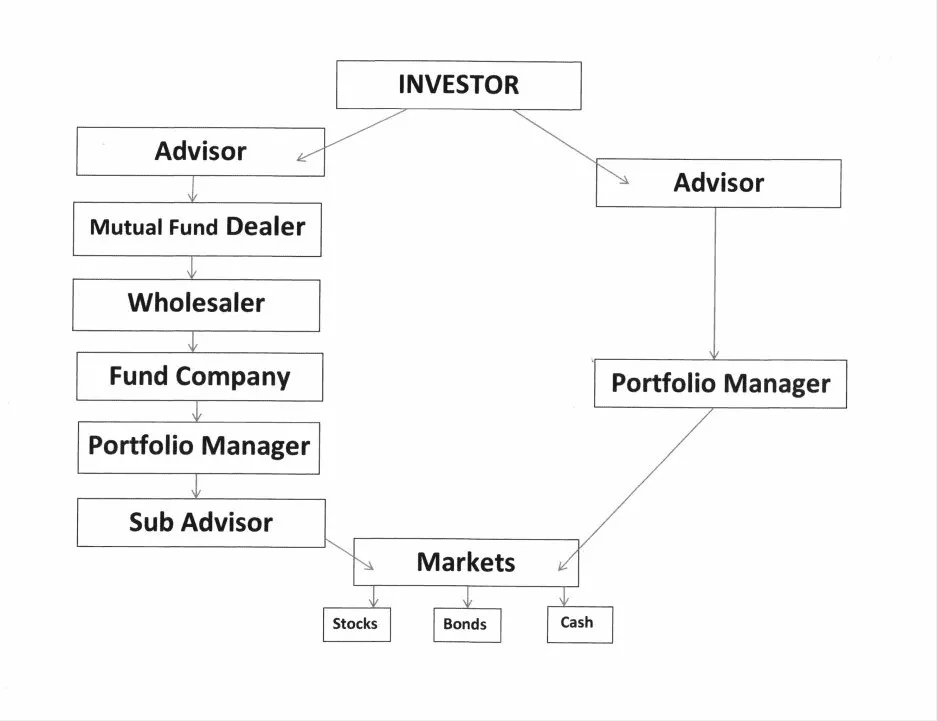

The graph below shows the breakdown of how many different layers, or functionaries, are used in the mutual fund industry. Using a Portfolio Manager involves less functionaries, which can keep costs down since less money is being paid in fees and services, thus making the management of your money much more efficient.

Here are some other benefits of using a portfolio manager:

• Active Management of your investment

• Trustee Barrier between the Portfolio Manager and your money

• Fully Liquid (No Deferred Sales Charges)

• Access to the person making decisions on your portfolio based on the mandate you give them

• Fees can be tax deductible

• Full Transparency

Accessible through Advisors at a lower threshold $100k per household

Pool together your spouse and childrens' accounts adding up to $100K or more from these types of accounts:

Canadian & U.S. margin and cash accounts

Individual and Spousal RRSP

RRIF, LIF and LIRA

RESP and RDSP

TFSA

Corporate

Individual Pension Plan

Individual and Spousal RRSP

RRIF, LIF and LIRA

RESP and RDSP

TFSA

Corporate

Individual Pension Plan

Tim Ramsay initially trained and practiced as an environmental consultant. Since 1983 he has helped to guide his clients in their insurance and investment needs. This advice has spanned many market cycles. Learn More