3 big shifts that make financial planning more important than ever

- By Tim Ramsay

- •

- 08 Jun, 2017

- •

Planning for an uncertain future is a specialty of Mark Halpern’s, a CERTIFIED FINANCIAL PLANNER® professional, Trust & Estate Practitioner and CEO of WEALTHinsurance.com. According to Mark, Canadians are experiencing three major shifts that will impact how much we have to save and the financial planning choices we make.

1. WE’RE LIVING LONGER

Since 1980, World Bank figures show the average life expectancy in Canada increased from 75 to 81 years. And while 16% of Canadians are over 65 today, that number is expected to increase to 23% of the population by 2041, according to the University of Ottawa. That means we may have to save more than we think, especially since medical costs and associated expenses (like home care, prescription drugs, mobility aids, or modifications to our homes to allow for challenges to mobility) tend to increase as we age. Medical and everyday expenses could pile up if we live longer than originally anticipated, a reality given the advances in science and improved health care.

2. FUTURE GOVERNMENT COVERAGE MAY DECREASE

As a greater proportion of the population ages and medical costs become exponentially higher, we may not be able to rely on the government to pick up the tab for costs that are covered now. “The challenges are not a political statement, but a basic math problem,” says Mark. “They may affect things we take for granted, such as long-term care.” The longer we live, the higher these costs will be―and the greater the need to plan for them.

3. THE “MISINFORMATION AGE”

The third shift is our clear entry into an information age―Mark calls it the “misinformation age”―where we’re encouraged to showcase our lifestyles by sharing updates about newly acquired goods or expensive vacations on social media.

In addition to the lure of a consumer culture, we’re getting worse at separating good information from bad due to the sheer volume we’re exposed to on a daily basis.

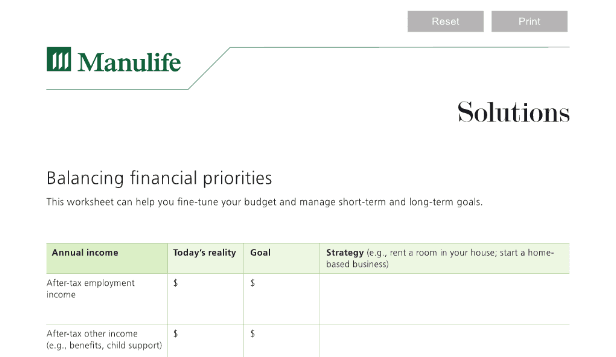

HOW A CFP® PROFESSIONAL CAN HELP

Meeting with a CFP professional can pinpoint what’s really important to us and help us develop a sound plan to achieve it.

Mark says the first step is to sit down with a professional and ask how to get started. “A CFP professional will look at things very holistically. It’s a question of doing the right diagnostics―a doctor doesn’t give you a prescription without forming a diagnosis. We ask the hard and soft questions on assets, earnings, taxes, and everything else about your financial life and your personal situation and goals. And you should never hold anything back―that would be like not telling a doctor about something that’s hurting you.”

Mark believes everyone can benefit from financial planning, even those who think they have their finances under control. “Even if you think you’re organized and well-prepared, get a second opinion. It’s very rare that we’ll find someone whose plan we can’t optimize in some way,” he says. “A CFP professional will have the most current information and expertise to help you put together a new, more effective strategy for your financial future.”

For help getting through the big shifts and the smaller ones, find a CFP professional in your area with our Find Your Planner tool.

For more on the importance of financial planning and how it can help you reach your goals, read The Value of Financial Planning, Financial planning can help anyone at any life stage, and Live your bucket list: 8 ways to turn goals into reality.

- See more at: http://www.financialplanningforcanadians.ca/financial-planning/3-big-shifts-that-make-financial-plan...