3 ways to keep your finances on track in the gig economy

- By Tim Ramsay

- •

- 08 Jun, 2017

- •

There are many benefits to being your own boss: flexible work hours, choosing the most interesting projects and contracts, and vacations when you choose. Those upsides may come at a price, however. They often mean an income that fluctuates dramatically from one month to the next, along with a lack of employment insurance or benefits.

Without proper planning, that income uncertainty can make it difficult to budget, save and manage debt.

Whether you’re a freelancer, contractor or commissioned worker, there are strategies you can use to help lessen some of the challenges and set the stage for a rewarding future, says David Salloum, a CERTIFIED FINANCIAL PLANNER® professional and senior wealth advisor with RBC Dominion Securities in Edmonton.

For those facing fluctuations in income, David offers these tips to help set you on the path to financial stability:

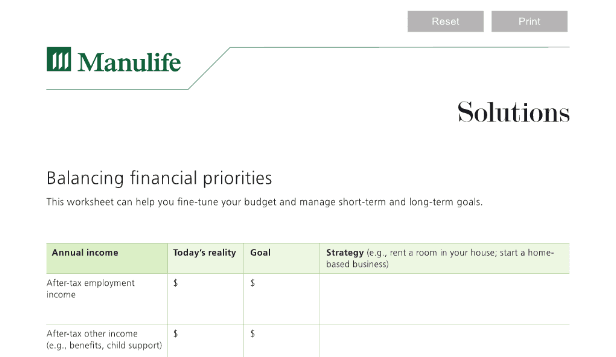

1. BUDGET THE BASICS:

While it may seem difficult to establish a budget with an irregular income, it’s essential in understanding how much money you need for basic living expenses (think life insurance, rent or mortgage, utilities, groceries, transportation, phone and internet costs). Knowing how much you must have each month eliminates the guessing game, anxiety and constant shuffling of funds from one place to another to cover the necessities.

2. PREPARE FOR THE UNEXPECTED:

Job loss, medical emergencies, or unexpected home or vehicle repairs can all come at the most inopportune time. Creating an emergency fund with three to six months of liquid income means bills can still be paid while credit card debt, personal loans and stress are kept to a minimum.

3. KEEP CURRENT:

Revisit your budget and financial plan on a regular basis, particularly when circumstances change. These should be fluid documents, to allow for change and revised priorities. And staying up-to-date isn’t only about money matters: During slower periods, take the time to update skills and areas of expertise. And network, network, network. After all, you never know where the next opportunity is waiting and what it may bring.

These steps are just the beginning. A CFP® professional can help steer you in the right direction and ensure that you allocate funds for semi-annual or annual payments such as house insurance; secure health and benefit packages that best meet your needs; plan for income taxes, children’s education and your retirement; and manage debt.

The challenges that come with uncertainty can be greatly relieved by having a financial plan in place that covers all the bases and guides you along the path. “It will help bring control, peace of mind, and confidence in knowing that you can deal with whatever may come along,” says David.

To find a CFP professional in your area to help you stay on track regardless of income fluctuations, use our Find Your Planner tool.

For more on taking control of your finances , read 5 important financial pitfalls for millennials, Conquer your fear of missing out to get on top of your finances and I’m too young for financial planning…aren’t I?

- See more at: http://www.financialplanningforcanadians.ca/financial-planning/keep-your-finances-on-track-in-the-gi...