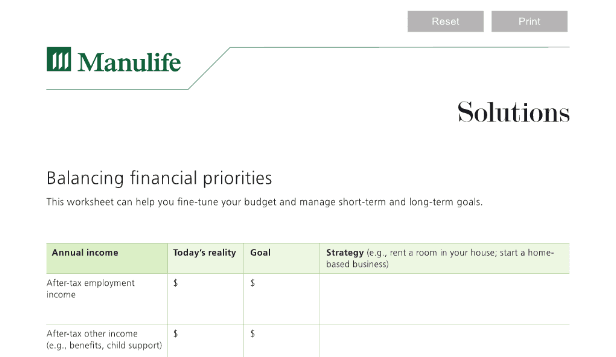

Financial priorities worksheet

- By Tim Ramsay

- •

- 30 Oct, 2017

- •

This worksheet can help you fine-tune your budget and manage short-term and long-term goals.

f you’re a busy professional, tax time can be a stressful time of year. If you’re also retiring or recently retired, self-employed or own a business, a commissioned salesperson, or are going through another significant life change, your taxes may have a new level of complexity that often benefits from professional support. - See more at: http://www.financialplanningforcanadians.ca/financial-planning/prepare-for-taxes#sthash.ery2aiHy.dpuf

Planning for an uncertain future is a specialty of Mark Halpern’s, a CERTIFIED FINANCIAL PLANNER® professional, Trust & Estate Practitioner and CEO of WEALTHinsurance.com. According to Mark, Canadians are experiencing three major shifts that will impact how much we have to save and the financial planning choices we make. - See more at: http://www.financialplanningforcanadians.ca/financial-planning/3-big-shifts-that-make-financial-planning-more-important-than-ever#sthash.FmbXp3to.dpuf

There are many benefits to being your own boss: flexible work hours, choosing the most interesting projects and contracts, and vacations when you choose. Those upsides may come at a price, however. They often mean an income that fluctuates dramatically from one month to the next, along with a lack of employment insurance or benefits. - See more at: http://www.financialplanningforcanadians.ca/financial-planning/keep-your-finances-on-track-in-the-gig-economy#sthash.TNmZU49Q.dpuf