HOW TO DEAL WITH 4 AWKWARD MONEY MOMENTS

- By Tim Ramsay

- •

- 31 Oct, 2017

- •

We've probably all experienced the stress of an awkward money moment, whether it's at a restaurant, at a party, or even at home. But how do you defuse such a tricky situation?

Here are four typical scenarios and tips for avoiding embarrassment:

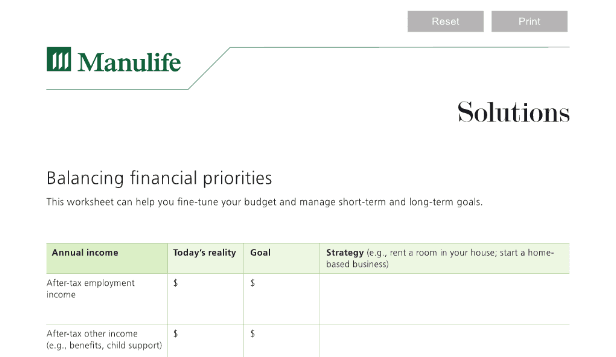

1. SPLITTING THE RESTAURANT BILL:

You regularly go out with a group of friends and everybody except you enjoys a couple of high priced cocktails along with their meal. In the past you've equally split the bill, but your portion is always much less and you end up paying more than you should. What do you do?

The solution is to speak up. You won't be the first person to reach for the tab and say, "It looks like my share is about $30." Nor will you be the first to request separate bills—ideally you’ll avoid the whole problem before you order by asking the server to tally everyone separately. By taking the lead, you make it easier for everyone. Your response, however, may depend on the size of the group and strength of your relationships. For example, you may be more open to splitting the total if it's just you and a good friend who meet for lunch often.

2. CHARITY AT THE OFFICE:

Your close friend says she has had an unexpected financial emergency with a matter of days to come up with a sum of money, and is asking for a loan. What do you do?

This is a potential relationship killer! Is the person—and the reason she wants the loan—responsible in your opinion? And is the amount something you can afford? If you can spare the money, then one option is to offer to give her the money with no strings attached. You can also offer to help her find other appropriate solutions such as organizing a budget, credit counseling or talking to a professional financial planner to create a plan to handle any future financial emergencies.

While there’s often good reason to lend money to a relative or close friend in need and real satisfaction to be gained by helping out, you’re entering a relationship minefield when you do so. If you do choose to lend money, consider creating an agreement with explicit terms around interest required, payment due dates and consequences for late payments and default. And if your friend opts for a bank loan and asks you to co-sign, carefully consider all aspects and regretfully decline if you question her ability to pay it back. You’ll be on the hook to pay if she defaults and your credit rating could be negatively impacted.

For more, read 5 tips on loaning money to family.

4. THE NOSY PARTY GUEST WHO WANTS TO TALK ABOUT YOUR FINANCES OR BRAG ABOUT HIS:

At a party, you announce that you're buying your first house. One of the other guests immediately asks, "How much was it?" What do you do?

A general answer with no specifics, such as "More than we wanted to" or "We got a great deal" may be enough to deflect a follow-up question. But if not, and you're not comfortable answering, you can say, “I'm not comfortable going into details" or "That's not something that I talk about". Talking about money isn't taboo, and people brag all the time about the bargains they scored or the investment they just doubled their money on. But it should be up to the person who made the purchase to make it clear the subject is open for discussion. Inquiring about how much someone paid, or how much he or she earns, is just rude. Don't be afraid to protect your personal information.

Being smart with your money includes not getting caught off-guard with unwanted money conversation topics or requests. Be proactive and make a plan ahead of time for how you’ll respond. Your wallet—and pride—will thank you.

For help in taking control of your finances, find a CERTIFIED FINANCIAL PLANNER® professional - Contact Me Today!