Making Tax Time Less Taxing

- By Tim Ramsay

- •

- 08 Jun, 2017

- •

f you’re a busy professional, tax time can be a stressful time of year. If you’re also retiring or recently retired, self-employed or own a business, a commissioned salesperson, or are going through another significant life change, your taxes may have a new level of complexity that often benefits from professional support. Traditionally, this help comes in the form of a bookkeeper and/or an accountant, but there is one more expert worth considering as a valuable member of your tax team: a CERTIFIED FINANCIAL PLANNER® professional.

Kurt Rosentreter, CPA, CA, CFP®, CLU, TEP, FMA, CIMA, FCSI, CIM is a Senior Financial Advisor and Associate Portfolio Manager for Manulife Securities Incorporated. As a Chartered Professional Accountant and a CERTIFIED FINANCIAL PLANNER professional, Kurt is uniquely positioned to talk about the role of a financial planner when it comes to your taxes.

AN ACCOUNTANT FILES YOUR TAXES―BUT A CFP PROFESSIONAL PLANS FOR THEM

Getting your taxes done by an accountant can be a smart move for anyone—not just those with more complex tax situations. Accountants keep on top of regular changes to the tax code and engage in ongoing professional development to ensure they’re using the best strategies for their clients at tax time.

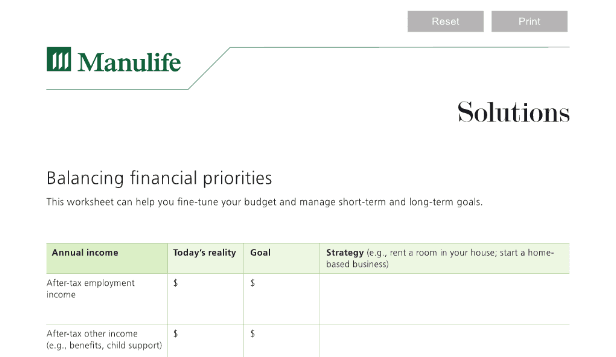

So why would you add a CFP professional into the mix? Simply put, while an accountant’s job is to file your taxes with the maximum benefit to you at tax time, a CFP professional will make sure that your taxes fit with your short and long-term financial strategy throughout the entire year. “A CFP professional’s first task is to help clients identify the sources and types of income they have, how these will change over time, and how tax will evolve with them,” according to Kurt.

A CFP professional can also help make tax time easier by ensuring that your accountant has all the paperwork he or she needs to file your taxes correctly and on time. For example, if your accountant doesn’t know that you have a brokerage account, they aren’t going to ask you for a tax slip for that account—they just work with what you give them.

“Working with a CFP professional gives the accountant more to work with,” says Kurt. “An accountant may not see everything because they’re focused on the tax return. A CFP professional takes a holistic view of the entire financial picture, rather than just the taxes.”

THE IMPACT OF LIFE EVENTS

“Life events— career changes, marriage, divorce, children, health issues, retirement—can materially impact the taxes you pay,” says Kurt. “In particular, retirement is one that likely affects us all eventually, as we transition from our employer withholding taxes to having to pay tax installments.”

Career changes can also be a challenge at tax time. For instance, if you are changing jobs and face a change in income or benefits, your CFP professional can help you optimize your current situation through effective tax planning.

“A CFP professional will be instrumental in helping you sort out the financial impact of all the transitions you’ll encounter throughout your life,” says Kurt.

SELF-EMPLOYED PROFESSIONALS NEED MORE HELP

Kurt identifies self-employed professionals as being especially susceptible to tax challenges. In addition, “someone who’s an expert at their chosen profession isn’t necessarily good at managing taxes and tax payments,” he says. “A CFP professional can manage all the different aspects of their finances and keep things organized so there aren’t any tax surprises.”

A CFP professional can also play an important role as a “translator” between an accountant and their mutual client. “A CFP professional is a good go-between to help educate the client and ensure that tax planning fits into the client’s long-term financial strategy. This helps the client pull it all together and ultimately achieve more financial knowledge and control.”

PLANNING FOR PAYMENTS

For many Canadians, taxes are withheld and submitted by their employer. But for others, Kurt explains, it isn’t quite that simple.

“If you’re self-employed, you have to remit taxes periodically. Or if you’re retired, you may have investment income where there is no tax withheld, so you’ll need to pay it yourself. A CFP professional will help map out how taxes are paid and ensure you’re setting aside enough income tax so you’re prepared for the payments you’ll need to make. They’ll also help you avoid surprises by alerting you to events that might trigger tax bills and helping you plan the tax payments in advance.”

If you want to minimize the anxiety generally associated with tax time and avoid surprise bills and penalties, consider adding a CFP professional to your tax team.

For help with your taxes—and every other aspect of your finances—find a CFP professional in your area with our Find Your Planner tool.

For more on tax planning, read 5 ways early tax planning keeps money in your pocket, How to banish the RRSP rush and 5 top tips for making year-end donations.

- See more at: http://www.financialplanningforcanadians.ca/financial-planning/prepare-for-taxes#sthash.ery2aiHy.dpu...