4 ways to get your adult children on the road to financial independence

- By Tim Ramsay

- •

- 08 Jun, 2017

- •

With student loans, unemployment and underemployment, and rising costs across almost every aspect of life, it’s hardly surprising the bank of Mom and Dad has gone from a stopgap financial solution to a necessity for some adult children. Facing significant financial challenges at the beginning of adult life, many millennials are leaning on their parents in order to buy a car, put a down payment on a home or start a family.

While it’s okay to help adult kids on an occasional or short-term basis, supporting them financially over the long-term can hurt both sides of the equation. Parents may be putting their own financial future at risk, if they find themselves unable to meet existing obligations or realize retirement dreams. At the same time, adult children who fail to learn financial responsibility are ultimately putting their own goals and dreams in jeopardy. After all, Mom and Dad won’t be around to help out forever.

Ensuring that the future looks bright for everyone means helping adult children to realize financial independence as soon as possible, says Marc Lamontagne, a CERTIFIED FINANCIAL PLANNER® professional with Ryan Lamontagne Inc. in Ottawa.

So how can you help get your adult children on the road to financial self-sufficiency? It starts with these simple steps, says Marc:

1. SET LIMITS:

An open wallet provides no incentive to curtail spending. Set a limit on how much financial assistance you’re prepared to give and for how long. If it’s a loan, put it in writing with a payback schedule and a signature to acknowledge that it’s a real commitment. Learn how to say ‘no’ to requests for more.

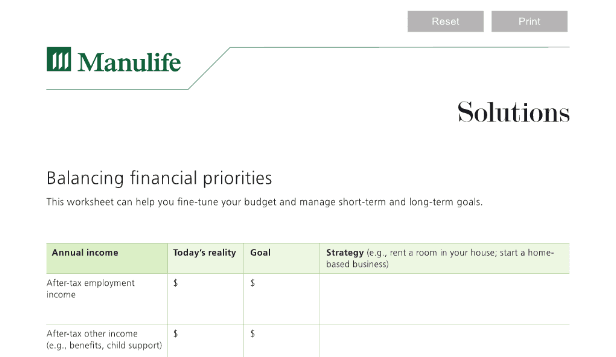

2. ESTABLISH A BUDGET:

It sounds pretty simple, but it’s surprising how many young adults are unaware of their monthly expenses. Once a budget has been established, it’s easier to determine how much supplemental income they need from you—and where cuts can be made to gradually reduce financial assistance and increase savings over time.

3. WORK TOWARD A GOAL:

If an adult child wants a car or their own apartment, have them write down these short- and long-term goals. Then, take them through the steps necessary to get them there, including reducing spending or getting a part-time job. One option parents could offer is to match what their child saves, providing the motivation to help them reach a goal faster.

4. TEACH GOOD HABITS EARLY:

The sooner children learn how to manage money, credit, debt and spending the better. It doesn’t have to be a tedious discussion, just simple lessons as part of life, such as saving an allowance for a special toy.

Marc says he’s seeing a real trend toward parents bringing adult children to the annual financial review with their CFP professional. “We have a long discussion about investments, taxes and estate planning. It provides a real educational opportunity to gain a clear understanding of a parent’s financial situation and what their needs will be later in life.”

Weaning adult children off the bank of Mom and Dad may mean setting some firm boundaries and spending time on education. But the rewards will be well worth the effort.

To find a CFP professional in your area to help guide your financial future—and get your children off to a good start—use our Find Your Planner tool.

For more on families and money, watch Loaning money to your children and read How to have “that talk” about money with your spouse and family and Modern families have one thing in common: They need a plan.

- See more at: http://www.financialplanningforcanadians.ca/financial-planning/building-financial-independence-in-ch...