Wait Before You Pre-Spend That Tax Refund

- By Tim Ramsay

- •

- 08 Jun, 2017

- •

This is a subtitle for your new post

By Kelley Keehn, FPSC Consumer Advocate

Originally published by Tangerine Forward Thinking. Republished with permission.

With tax season behind you and the anticipation of a juicy refund on the way, it's hard not to pre-spend that windfall from the government. But not so fast, says CERTIFIED FINANCIAL PLANNER® professional Shannon Lee Simmons from The New School of Finance. Remember that a refund is really your money being returned to you from the government and without interest. So it's really not found money at all.

Shannon says Canadians compartmentalize money: "With found money, people tend to make less responsible decisions. It feels like a windfall, and there's nothing wrong with that. If you weren't expecting a refund, and your accountant tells you you're getting $3,000, I would argue that it's likely going to go to a lovely new patio set."

FOUND VS. UNEXPECTED MONEY

Shannon points out that while found money may be treated one way, someone's bonus from work, for example, may get a completely separate set of attention and financial planning responsibility around it, "because that's something that they 'baked' into their overall financial plan," she says.

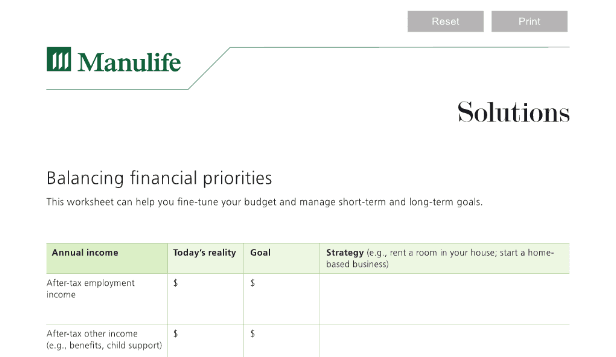

The problem with anticipated money is that it's not guaranteed—especially with a bonus. Shannon cautions that if "they don't end up getting it, they could be in trouble." For example, even if the family is prudently pre-spending their expected bonus money, but say, not making extra payments on the mortgage or investing in an RSP or TFSA monthly because of this expected windfall at the end of the year, if they don't receive that "bonus", their financial situation could become troublesome.

Shannon advises that if you're a person counting on windfalls, "It's still really important to set up those monthly contributions just in case it doesn't arrive. Because you can't control windfalls — they're uncontrollable by their very nature."

EMOTIONAL MONEY MISTAKES AT TAX TIME

Shannon explains that many things can affect what you think will be a guaranteed tax refund. "Maybe they sold some stocks that year, or had two jobs and one didn't take off enough tax. Something happened and that refund isn't necessarily as predominant as they wanted it to be or as big as they wanted it to be, they're going to be really disappointed."

Shannon adds that a bigger problem is "A lot of time, people will make plans based on what they had last year. I find that's such a bias that we all have—if your life doesn't feel like it's changed that much, you're probably going to assume that your tax bill is the same as it was last year. So if you owed a bunch of money last year, you might be scared of tax time because you're worried you're going to owe again. And if you got a massive refund last year, you're likely expecting the same thing. But that can be dangerous. Because if you don't fully understand what's happening behind the scenes with your taxes, there's a lot of moving parts that you might not realize were affecting that."

SHANNON'S GUIDANCE

"Always keep an open mind," she says. "Whatever happens will happen, and don't spend the money until you know that it's guaranteed from the government as well. When it comes to an unexpected windfall—with tax refunds specifically—I give clients permission to, say, blow half of it on whatever makes you feel good. And with the other half, let's try to do something to better your financial situation and circumstance. We're not just on this earth to pay our cell phone bill. I get it. It's a windfall, that's great. But do try to put some of it aside to pay off debt or put back into your retirement savings."

For help planning for your taxes, find a CFP® professional in your area with our Find Your Planner tool.

For more on tax planning, read Making tax time less taxing, 5 ways early tax planning keeps money in your pocket, and 5 top tips for making year-end donations.

- See more at: http://www.financialplanningforcanadians.ca/financial-planning/wait-before-you-spend-that-tax-refund...