Long Term Care Planning: What Is It and Why Should I Care?©

- By Tim Ramsay

- •

- 16 May, 2017

- •

By Karen Henderson Long Term Care Planning Network

We all take delight in planning for vacations and holiday celebrations but when it comes to planning for old age, we literally run the other way. Aging and death only happen to other people, and therefore we don’t need to talk about it – at least not yet. Why is this?

- Canadians have an attitude of entitlement; I am a taxpayer and therefore the government is responsible for caring for me in my old age

- It won’t happen to me

- My spouse will look after me

- The kids will look after me

- The first wave of Canada’s 10 million boomers started turning 60 in January 2006

- 1000+ people turn 65 every day

- By 2038, over 1,125,200,000 Canadians will have Alzheimer’s disease or a related dementia unless a cure is found before then.

These realities make it abundantly clear that we all need to plan for old age – and not just financially. We need to understand the health care system where we live, plan where we wish to age and live out our lives, and communicate our wishes to family members and health care providers.

The bottom line: Long term care planning needs to be a part of every financial and/or retirement plan written today.

Here’s how to begin:

Step One: Understand the health care system and care settings and services where you plan to live as you age

Step Two: Know whom you can count on for care and support, both from your family and from health care professionals

Step Three: Talk with your family about what you want – hold a family meeting. Understand your family history and what chronic conditions you have or may face

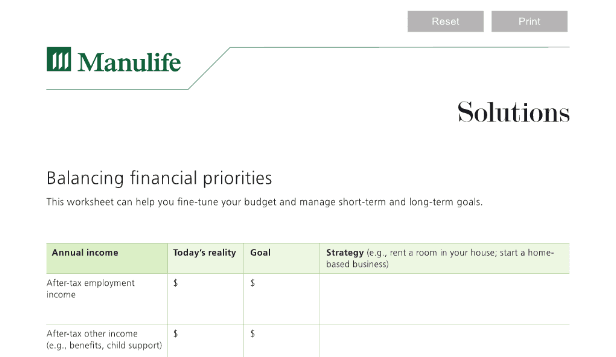

Step Four: Ensure you have a financial plan developed by you and your financial advisor that includes funding for long term care

Step Five: Establish clear legal directions. Complete a will, Powers of Attorney and make copies available to those who need them

Set Six: Gather all critical personal, health, legal and financial information and store it in one place for easy access

Step Seven: Communicate the plan to your family and update it every year

Creating a care plan will take time and effort, but once it is completed, you will

have accomplished two very important goals:

- You will have added the missing piece to your financial/retirement plan

- You will have removed a huge burden from your family; over time you all will be thankful that you took the initiative to plan ahead

As the saying goes: Just do it!